MEDICARE COSTS Explained

Part A Costs | Part B Costs | Part C & Medigap Costs | Part D Costs | Adding it All Together

Wondering what your Medicare will cost you this year? You’re not alone. Being able to plan ahead to meet your healthcare needs while also being financially responsible is an important skill!

When we talk about cost, it is important to understand the different elements of paying for insurance and healthcare that, when added up, combine to form your overall cost. Get familiar with the following terms because there terms are a big part of your costs on Medicare - visit our glossary for more helpful definitions of Medicare and insurance terms:

Premium(s) - an amount you pay regularly (usually monthly) to simply stay enrolled in a benefit or plan.

Deductible(s) - an amount you must pay out of your own pocket first, before your benefit or plan will start covering costs.

Coinsurance - after you’ve paid your deductible and your coverage has kicked in and paid for its share of cost, this is the amount that you must pay for services.

For example: Medicare Part B has a coinsurance amount of 20%, meaning that it pays for 80% of the approved costs and so you are responsible for paying the remaining 20% of costs.

Copayment - An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. *This is a common sight in most Part C Medicare Advantage plans.

In order to help you plan, we’ve put together a rough estimate of the general costs you can expect on Medicare, as well as a more detailed breakdown of costs for Part A, Part B , Part C , and Part D.

How does this all add up? We’ve also provided an example of what a typical person’s coverage and monthly costs may look like here.

Medicare Part A and Part B costs, premiums, deductibles, coinsurance for 2023.

Remember, some of these figures are based on the national average and may vary based on where you live and how much you earn. For a zero cost, zero-obligation personalized consultation to fit your area and income level, give us a call today!

Part A Costs | Part B Costs | Part C & Medigap Costs | Part D Costs | Adding it All Together

PART A COSTS

Remember, You can enroll in Part A as long as you have been a United States citizen, resident or green card holder for 5 years.

Part A Premiums - How much will you pay every month for Part A? Well, that depends:

Premium-Free Part A: Most people qualify for premium-free Part A, meaning that their monthly premium to keep their Part A active is $0. You will receive premium-free Part A as long as you have paid the Medicare payroll tax for a total of 10 years (or 40 quarters). This payroll tax is part of the FICA (Federal Income Contributions Act) taxes that were/ are deducted out of your regular paycheck. So, all those years that you spent paying the Medicare payroll tax went towards giving you premium-free Part A now! Which is great because the Part A monthly premium is expensive if you have to buy it - It’s over $506 every month!

Will I have to pay monthly for my Part A premium? Some people will pay a monthly premium for Part A. If you did not contribute to the Medicare Payroll tax for 10 years (or 40 quarters), or if you recently came to the country (but have been citizens, residents or green card holders for at least 5 years) then you still have the option to buy Part A. The average monthly premiums are around $506 per month.

What If I have worked and paid into Medicare payroll tax for 30-39 quarters? You should qualify for a reduced Part A premium, and you should only pay around $278 per month instead of the standard $506 premium per month!

What if I am on Medicaid and did not qualify for the Premium-free Part A? Don’t worry! Your state may offer assistance to help cover the cost of the premium every month, and depending on your Medicaid level, may even pay the entire amount for you monthly.

*In most cases, if you choose to buy Part A, you must also:

Pay monthly premiums for both Part A and Part B

Part A Costs (if you have Original Medicare and are NOT enrolled in a Part C or Medigap Supplemental)

In general, once you’ve paid your Part A premium (if you have one), you will likely be facing some deductibles, copayments and coinsurance amounts when you receive Part A covered services. The following information is for Original Medicare only. If you have a Part C plan or Medicare Supplement, your policy may eliminate the need for you pay a deductible, copayment or coinsurance amount.

**These are guidelines and may change each year. We recommend that you visit https://www.medicare.gov/your-medicare-costs/medicare-costs-at-a-glance for an exact and updated list**

Inpatient care in a hospital:

$1,600 deductible for each benefit period.

Days 1-60: $0 coinsurance for each benefit period.

Days 61-90: $400 coinsurance for each benefit period.

Days 91 and above: $800 coinsurance for each “lifetime reserve day” after you use up your 90 days allotment for each benefit period. **Think of lifetime reserve days as a credit of 60 extra days (you only get 60 extra days total for life) that you can use if you need stay in the hospital beyond any given 90-day benefit period.**

If you use up all of your lifetime reserve days, then you are responsible for all costs.

Inpatient care in a skilled nursing facility:

Days 1-20: $0 for each benefit period.

Days 21-100: $200 coinsurance per day of each benefit period.

Days 101 and beyond: You are responsible for all costs.

Hospice care:

$0 for hospice care.

You may have a copay of no more than $5 for each prescription drug or similar pain relief products.

You may pay 5% of the Medicare approved amount for respite care

Medicare does not pay for room and board if you receive hospice in your own home or nursing home you live in.

Home health care:

$0 for home health care services.

20% of the Medicare approved amount for durable medical equipment (also referred as DME).

Mental Health inpatient stay:

$1,600 deductible for each benefit period.

Days 1–60: $0 coinsurance per day of each benefit period.

Days 61–90: $400 coinsurance per day of each benefit period.

Days 91 and beyond: $800 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime).

Beyond lifetime reserve days : all costs.

20% of the Medicare-approved amount for mental health services you receive from doctors and other providers while you are a hospital inpatient.

TIP: As you can see, having only your Part A and Part B ( also known as ‘Original’ or ‘Traditional’ Medicare) is not a simple coverage solution for most people, especially because Original Medicare only covers 80% of your healthcare costs, and includes some high deductibles and coinsurance. The other thing to keep in mind is that there is no Maximum out of pocket limit on Original Medicare, meaning that your healthcare costs could quite quickly bankrupt you if you happen to fall seriously ill.

You can always control your out of pocket costs by adding either a Part C Medicare Advantage plan or a Medicare Supplement (Medigap) plan. Always remember that our team of ‘Even Better’ Medicare plan experts are standing by to provide you with a free consultation tailored to your healthcare needs and financial situation!

Part A Costs | Part B Costs | Part C & Medigap Costs | Part D Costs | Adding it All Together

PART B COSTS

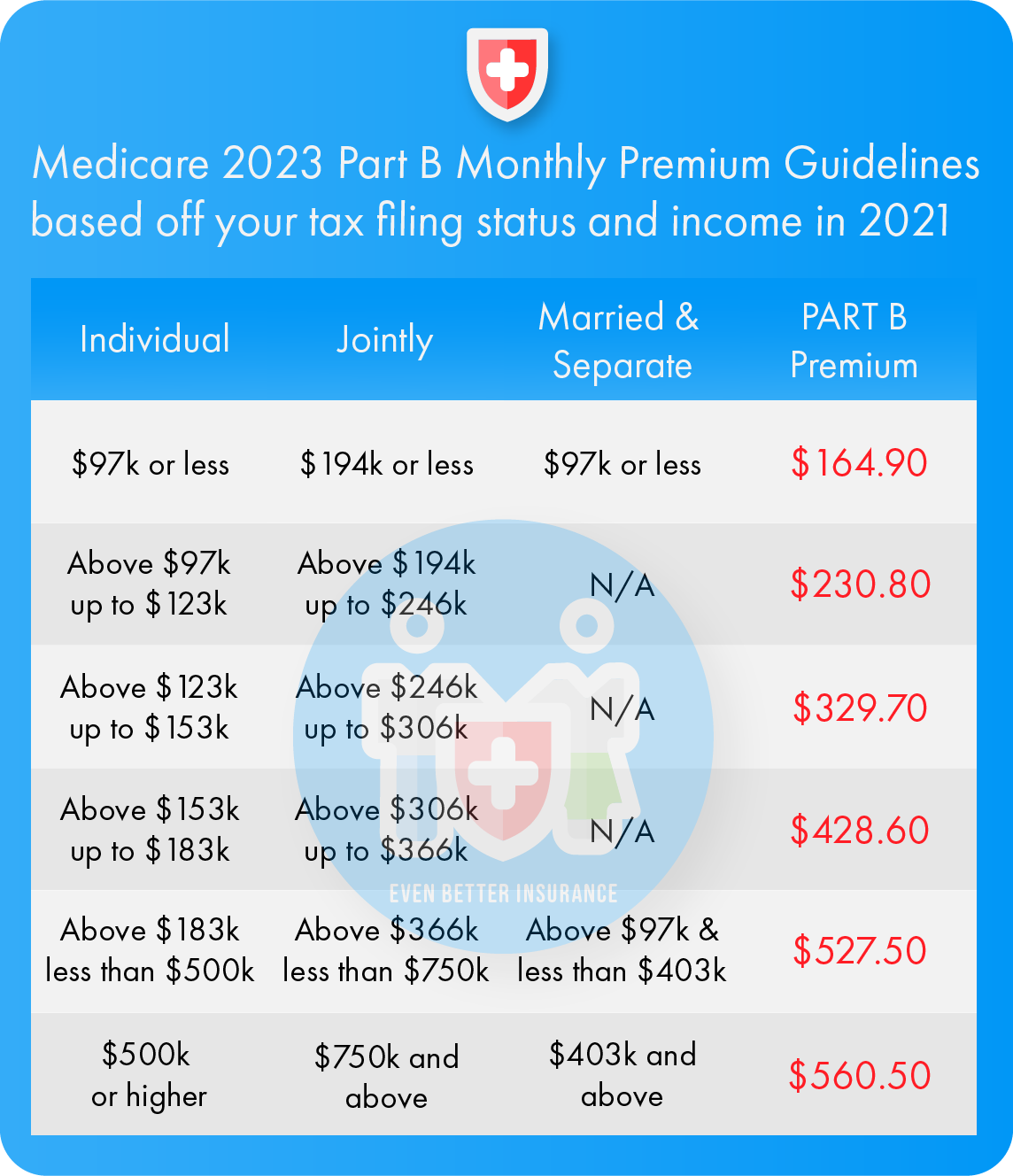

Part B Premiums - Most people pay the standard rate, but you may pay higher depending on your previous income.

In 2023, the standard premium amount of $164.90 per month. Similar to Part A premiums, however, the amount you’ll pay for your Part B is not the same for everyone.

How is my premium calculated? Your Part B premium is determined by your modified adjusted gross income (MAGI) listed on your tax return from 2 years ago. Why is it based off of your return from 2 years ago? Because that is the most recent tax return information provided to Social Security by the IRS.

Depending on your tax filing status and income, you may be subject to an additional charge known as an Income Related Monthly Adjustment Amount (IRMAA) which can raise your monthly Part B premium cost.

Example: If your yearly income in 2021 was $97,000 or less (if you filed as ‘single’ or as ‘married but filing separately’) or $194,000 or less (if you filed jointly with your spouse) then you will only pay the standard premium rate of $164.90 per month this year.

Your monthly Part B Premium depends on what you earned and how you filed in the past. You do have the option to file for a re-assessment! We’ll help you identify your Medicare costs so you can plan accordingly and avoid unwelcome financial surprises!

Remember the Part B premium changes from year to year. Social Security usually notifies beneficiaries in December of the premium changes for the upcoming year. It’s always important to understand and plan for what the costs may be as soon as possible.

How can I pay the Premium? Your Part B premium can be paid to the government in several ways. It can be automatically deducted if you currently get benefits from either Social Security, the Railroad Retirement Board, or the Office of Personnel Management. Or, it can be paid like any other bill if you do not receive benefits from one of those programs.

What if I am on Medicaid and cannot afford the Part B premium? Don’t worry! As with Part A, your state may offer assistance to help cover the cost of the premium every month, and depending on your Medicaid level, may even pay the entire amount for you monthly.

Part B Costs (if you have Original Medicare - Not enrolled in a Part C or Medigap Supplemental)

So you’ve paid your premiums and want to know what the actual services will cost you. After you pay your premium, when you use Part B covered services you may be responsible for a deductible and some coinsurance. Remember, this is for Original Medicare only. If you have a Part C plan or Medicare Supplement your policy may eliminate the need for you pay a deductible or coinsurance amount.

Part B Deductible

1. Before Medicare Part B coverage will pay its share, you have to pay your Part B yearly deductible first. In 2023, the Part B deductible is $226. This simply means that you have to pay $226 (this is a once a year cumulative limit you have to reach, not a monthly recurring deductible) in healthcare costs out of your own pocket before your Medicare Part B will begin to pay its share.

2. Once you’ve paid the deductible for the year ($226), Medicare Part B will cover its share of costs for Medicare approved services and you will be responsible for 20% of the Medicare-approved cost amount.

TIP With Original Medicare (Parts A and B together), there is a yearly deductible and there is no maximum out of pocket limit, meaning there is no limit to the costs you will have to pay every year for your care. We recommend considering adding a Part C (Medicare Advantage) plan or a Medicare Supplement (Medigap) because they will help you eliminate deductibles, and limit the maximum amount you’ll pay in a given year for healthcare.

Our ‘Even Better’ Medicare plan experts will help you compare options to find a plan in your area that will save you the most!

Part A Costs | Part B Costs | Part C & Medigap Costs | Part D Costs | Adding it All Together

PART C & MEDICARE SUPPLEMENT COSTS

Costs on Part C Medicare Advantage plans and Medicare Supplements (Medigap) vary widely based on the plans available in your area. Generally speaking, one of the major benefits to these types of coverages is that they can potentially reduce your deductibles and coinsurance; they can limit your yearly out of pocket maximum you’ll pay for healthcare; and can even give you a rebate towards your Part B premium in some cases!

Part C and Medicare Supplement Premiums

Some plans charge monthly premiums, some do not. As a general rule of thumb, monthly premiums on Medicare supplements tend to be much higher than Part C plans because of their wider access to networks.

Some Part C plans may even help pay for some or all of your Part B premiums!

Part C and Medicare Supplement Deductibles

Again, these vary based on the area you live in along with several other factors. Some plans have a deductible that you must meet while others have little to no deductibles, and may even pay for your yearly Part B deductible.

Part C and Medicare Supplement Copayments

Another potential benefit to these types of plans is that they may reduce the costs of doctors visits, inpatient or outpatient hospitalization and more when compared to having only Original Medicare (Parts A & B). Some plans have copayments and coinsurance while others might not.

For an individualized look at what plans are available in your area and which plans have the lowest deductibles, copayments and more, contact us today to schedule your zero-cost zero-obligation Medicare consultation! We comparison shop for you and present you the options that fit your goals and needs!

Part A Costs | Part B Costs | Part C & Medigap Costs | Part D Costs | Adding it All Together

PART D COSTS

Though not technically a part of Original Medicare, Part D prescription drug coverage is an essential tool to protect both you and your pocketbook in the event that you are prescribed life saving medications.

In general, the cost of Part D prescription drug coverage is comprised of 2-3 main elements:

Premiums. This is the cost (per month) to maintain your enrollment in the Part D plan you selected.

Copayments. Most Part D plans operate using a copayment model. That plan covers and classifies certain prescription drugs at different tiers. There can be up to 6 tiers. Every drug in a given tier has a copayment price that you must pay in order to receive that drug.

Deductibles. Certain drug plans may have a deductible that you must pay 100% of first before the plans covered drug copayments kick in.

A big source of confusion regarding the costs of Part D for a lot of people is the coverage gap (also known as the ‘donut hole’). We explain what the coverage gap is, and what you can expect when planning for your prescription drug costs throughout the year here.

PART D PREMIUMS

In 2023, the national average premium (also referred to as the ‘base beneficiary premium’) for a Part D plan is $32.74 per month. Again, the premium you’ll pay for a Part D plan varies by the area you live in, the type of plan you choose and, similarly to the way your Part B premium is calculated, the Modified Adjusted Gross Income bracket you fall in.

TIP Just like Part B, if you do not sign up for Part D when you are first eligible you will incur a late enrollment premium penalty - unless you have creditable coverage through an employer.

Part A Costs | Part B Costs | Part C & Medigap Costs | Part D Costs | Adding it All Together

ADDING IT ALL TOGETHER

Now that you’re familiar with the basic elements that make up your Medicare and insurance costs, Let’s take a look at an example of what a typical person’s coverage and monthly costs may look like:

Meet Bobby. Bobby was born in 1951, is single and made less than $97,000 in 2021. Bobby enrolled in Original Medicare (Parts A & B) and chose to add a Medicare Supplement plan (Bobby selected a Plan G supplement) and a Prescription Drug Plan.

Premiums:

Part A premium= $0.00 (most people qualify for premium-free Part A)

Part B premium= $164.90

Medicare Supplement (Plan G) premium = $190.00

Part D Plan premium= $32.74

Bobby’s monthly premiums total $387.64.

Deductibles:

Remember though that true monthly costs are not simply limited to premiums. Bobby also has deductibles that need to be met before his coverage pays its share. Because he chose a Plan G Medicare supplement, he still has to pay the once-a-year Part B deductible of $226 before his Medicare supplement will cover the rest of his medical and hospital costs. And, because he didn’t anticipate taking a lot of expensive medications, he enrolled in a lower monthly premium Part D plan which has a $250 deductible for any tier 3 or 4 (also known as brand name medications) drugs he may take. So:

Part B yearly deductible = $226

Part D plan’s deductible for brand name medication = $250

If he uses his respective coverages, then he is looking at potentially another $476 in deductibles at any given time during the year.

Copayments:

Once Bobby’s deductibles are met (remember, not all plans have deductibles) he may be subject to copayments for his medications. Let’s say Bobby is taking 5 generic drugs (his drug plan classifies generic drugs as tier 1 or 2 and charges a copayment of $5 for each 30-day supply of every generic drug) and 2 brand name drugs (his drug plan classifies brand name drugs as tier 3 - 6 and charges $42 for each 30-day supply of every tier 3 brand name drug).

As we learned a moment ago, his drug plan has a $250 deductible for tier 3 drugs and above. So, he will have to meet the $250 deductible when paying for those 2 tier-3 brand name drugs before his drug plan’s copayment rate of $42 per tier 3 drug kicks in. Once the deductible is met, from then on he may pay $109 this month in copayments to get he medications.

Bobby’s prescription copayments (for this month only) = $109.

Grand Total - $496.64 / month

When we add everything up (his premiums, deductibles, and copayments), Bobby’s healthcare costs total $496.64 this month.

Bobby, who is on a fixed income, was surprised at how quickly all these separate costs added up!

Determining your monthly costs will be a similar process. That’s why we strongly recommend that you consult an experienced agent to help you keep in mind all the variables and factors that determine what you’ll pay!

Our ‘Even Better’ Medicare plan experts will help you create a roadmap for your insurance coverage by identifying premiums, deductibles, copayment, and coinsurance costs ahead of time so that you can feel confident and comfortable with your coverage! Contact us today!

Part A Costs | Part B Costs | Part C & Medigap Costs | Part D Costs | Adding it All Together